Google and Motorola Mobility, hereafter Motorola, sitting in a tree m-e-r-g-i-n-g. Yes, Google is set to acquire Motorola and I, for one, think it’s awesome. I should preface this by noting that a dear friend is a long and loyal employee of Google so I’m biased to unqualifiedly support Google. This is truly the most exciting tie-up since AOL Time Warner and while this may end as badly, I find it highly doubtful. This acquisition has to be one of the top 10 M&A deals of all time. This radical decision by Google demonstrates an astounding willingness to diversify and expand into different markets. There are two main considerations when thinking about this deal; the impact on the mobile phone market, which has had enough ink spilled writing about it to necessitate the use of pencils for the next month, and more importantly, the combination of a 15 year old tech titan and an 83 year old manufacturing firm.

I understand that Google has many and fairly diversified revenue streams but its core business is internet search, and for the purposes of this article, mobile phone software. Let’s focus on the core for now. Google derives search revenue primarily from advertising. Does that mean that Google is basically a modern digital newspaper, television station, billboard, magazine, or radio station? Absolutely, the aforementioned mediums typically provide news, entertainment, or road adjacency to attract one’s attention, while Google provides access to the internet at your fingertips. The argument can be made that Google is better because there is interconnectivity; that is to say if I see a book in a magazine I have to go to a bookstore to buy it but on Google I click the link, add to cart, purchase and wait for a box to be dropped on my doorstep. Ah, the marvels of modern technology, except that once upon a time the printing press was considered revolutionary, forget 1080p ask your parents about color television and let’s not forget the phone book that also cataloged information and derived revenues from ad sales. Technology is constantly changing as Google supplanted Yahoo and Facebook, MySpace.

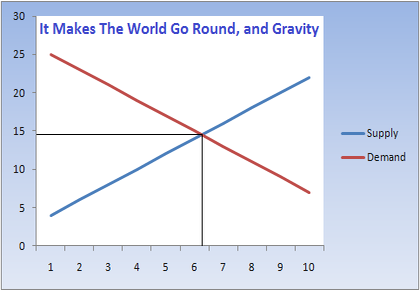

There are two important points to focus on here. First, as an advertising delivery method, Google is at the mercy of ever changing customer preferences and technology advances that have seen long established, powerful firms decimated. For any company to survive, particularly media companies, constant adaptation, matching offerings to consumer preferences is necessary to demand premium pricing. Second, Google makes money from selling advertising; advertisers are able to purchase those advertisements by selling goods or services. We’ll focus on the goods aspect because software is used to make computers, tangible goods, work better and legal, medical, or any other services make life easier. The core of the economy is the process of working to earn income to purchase goods, some necessities and some wants, and then services. Even a tech titan that skips over forward looking and goes straight to forward setting, like Google, really has strong exposure to the mundane manufacturing and retail sectors of the economy. Google has, in a fabulously bold step filled with bravado, taken this relationship one step further and decided to become a major player in the manufacturing of mobile phones. I can’t imagine being Larry Page; waking up one morning and before his first foot hits the ground he thinks I feel like buying Motorola, taking on Steve Jobs and Apple, pissing off my partners in a highly successful rollout of a mobile phone software platform, traipsing grease into my sheik Bay area offices (yes, I know Google has a machine shop on site), and oh yeah leaving my Jettisons’ air car to yabba dabba doo it up with the Flintstones by adding machine presses to my ones and zeros; hmmm I should have waffles for breakfast. If you don’t think Mr. Page considered these points guess again; this guy and his partner are smart enough to relevantly catalog, sort, index, and display well, everything – literally.

This brings us to the impact on the highly competitive mobile phone market. Motorola was an excellent acquisition target; the best phone I’ve ever had was my StarTAC. In terms of strategy, the highly competitive mobile phone market couldn’t be more essential; Apple wouldn’t be the world’s largest company sans the iPhone. Google’s strength in the market is a choice of handset providers and several new offerings on a regular basis, but it is also a detractor as there is immense anticipation of the iPhone and little for Android phones. Owning a handset manufacturer could provide a premium model that garners the attention of the iPhone but this leads to a major problem; lack of parity between Motorola and other handset manufacturers. For now, at least, Google’s partners have to smile and roll with the acquisition but in the medium term it is likely they won’t appreciate competitive advantage afforded Motorola and Windows 7 may become the new multi-manufacturer platform. This is not great from a competitive stance because Windows 7 is currently weak and the shuffling of software could create an opening for the currently ailing RIM, the forbearer of smart phones, to cement itself as a major handset provider thusly expanding the software market from a likely two to a likely four. That’s not so bad though because competition is good for consumers and producers and something as ubiquitous as mobile phones are too vast for just two operating systems or manufacturers. There is however, a greater concern that is this isn’t Google’s first foray into the handset business but Motorola’s experience should more than compensate. There are risks and Google definitely would do well to maintain a robust customer base in the relatively high margin software business especially as it also operates in the lower margin, higher risk manufacturing side of the industry. In any event strong management should prevent downside to this deal and the bold, unconstrained thinking of Google’s leadership, as is evidenced by this fantastic acquisition, should continue to ensure prosperity and hopefully bridge “new” and “old” economies.

{ 0 comments… add one now }

You must log in to post a comment.